SBR also intends to curb regulatory arbitrage available to very large NBFCs whose size of operations are more or less in line with that of banks. The portion of the consolidated minimum Total Capital requirement plus the capital conservation buffer (ie 10.5% of consolidated RWA) that relates to the subsidiary. The portion of the consolidated minimum Tier 1 requirement plus the capital conservation buffer (ie 8.5% of consolidated RWA) that relates to the subsidiary.

The Basel-I defined two tiers of the Capital in the banks to provide a point of view to the regulators. The Tier-I Capital is the core capital while the Tier-II capital can be said to be subordinate capitals. Replacement can be concurrent with redemption of existing AT1 capital instruments. The national bank or Federal savings association does not create at issuance of the instrument, through any action or communication, an expectation that the call option will be exercised.

The Basel III norms introduced Tier 1 leverage ratio to prevent banks from excessively leveraging their businesses. Additional Tier 1 capital is composed of instruments that are not common equity. A bank's capital consists of tier 1 capital and tier 2 capital, and these two primary types of capital reserves are qualitatively different in several respects . Under Basel III, a bank's tier 1 and tier 2 assets must be at least 10.5% of its risk-weighted assets, up from 8% under Basel II. Under the Basel Accord, a bank has to maintain a certain level of cash or liquid assets as a ratio of its risk-weighted assets.

The Basel Committee also observed that banks have used innovative instruments over the years to generate Tier 1 capital; these are subject to stringent conditions and are limited to a maximum of 15% of total Tier 1 capital. This part of the Tier 1 capital will be phased out during the implementation of Basel III. Basel III introduced tighter capital requirements in comparison to Basel I and Basel II. Banks’ regulatory capital is divided into Tier 1 and Tier 2, while Tier 1 is subdivided into Common Equity Tier 1 and additional Tier 1 capital.

However, a bank is required to have prior supervisory approval to include in capital an instrument which has not been paid-in with cash. Payment of cash to the issuing bank is not always applicable, for example, when a bank issues shares as payment for the take-over of another company the shares would still be considered to be paid-in. No regulatory adjustments are applied to fair value changes of Additional Tier 1 or Tier 2 capital instruments that are recognised on the balance sheet, except in respect of changes due to changes in the bank’s own credit risk, as set out in CAP30.15.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The effects of the revised standards will vary, depending on each bank's business model. An updated version of the accord, called Basel IV, began implementation in January 2023.

Calculating Common Equity Tier 1 (CET Capital

Total capital minority interest, subject to the limitations set forth in § 3.21, that is not included in the national bank's or Federal savings association's tier 1 capital. The national bank or Federal savings association must receive the prior approval of the OCC to exercise a call option on the instrument. The national bank or Federal savings association must receive prior approval from the OCC to exercise a call option on the instrument.

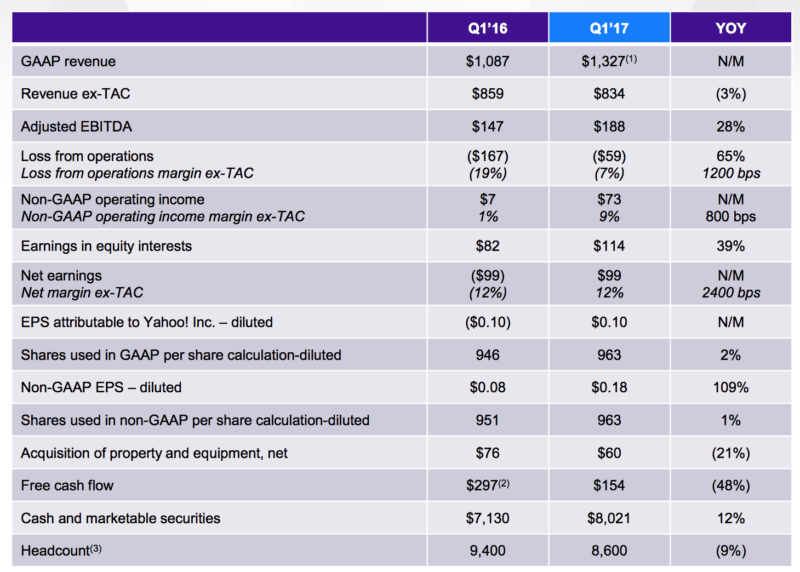

Capital ratios are commonly measured as a percent of bank assets or risk-weighted bank assets. The chart below plots the behavior of two measures of U.S. commercial bank capital ratios over recent years. The Tier 1 capital ratio is the ratio of a bank's core equity capital to its total risk-weighted assets . Risk-weighted assets are the total of all assets held by the bank weighted by credit risk according to a formula determined by the Regulator (usually the country's central bank). Most central banks follow the Basel Committee on Banking Supervision guidelines in setting formulae for asset risk weights.

The NBFCs in the Upper Layer (NBFC-UL) would comprise of those NBFCs which are specifically identified as warranting enhanced regulatory requirement based on a set of parameters and scoring methodology and the top ten eligible NBFCs in terms of their asset size. The upper layer would consist of a small number of NBFCs, which are significant from the point of view of systemic spill-overs and are therefore required to be subjected to tighter regulations, which would be in line with regulations applicable to banks. Total capital instruments of the subsidiary issued to third parties minus the amount of the surplus Total Capital of the subsidiary attributable to the third-party investors. The Common Equity Tier 1 in the illustrative example in CAP99 should be read to include issued common shares plus retained earnings and reserves in Bank S. To meet the point-of-non-viability requirements, the instrument needs to be capable of being permanently written off or converted to common shares at the trigger event.

CET1 comprises a bank’s core capital and includes common shares, stock surpluses resulting from the issue of common shares, retained earnings, common shares issued by subsidiaries and held by third parties, and accumulated other comprehensive income . The tier 1 capital ratio measures a bank’s core equity capital against its total risk-weighted assets—which include all the assets the bank holds that are systematically weighted for credit risk. For example, a bank’s cash on hand and government securities would receive a weighting of 0%, while its mortgage loans would be assigned a 50% weighting. Tier 1 capital represents the core equity assets of a bank or financial institution. Tier 1 capital is the core measure of a bank's financial strength from a regulator's point of view. It is composed of core capital, which consists primarily of common stock and disclosed reserves , but may also include non-redeemable non-cumulative preferred stock.

Other Comprehensive IncomeOther comprehensive income refers to income, expenses, revenue, or loss not being realized while preparing the company's financial statements during an accounting period. From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now tier 1 capital components to where you want to be — a world-class capital markets analyst. The above two are generally known numbers that can be seen in the published accounts. Tier 2 capital cannot exceed Tier 1 capital, which means that effectively at least 50% of a bank’s capital base should consist of Tier 1 capital.

Risk-weighted assets

The financial institution evaluates the Tier 1 leverage ratio, debt to equity ratio and debt to capital ratio for this purpose. Basel III provides for a comprehensive list of regulatory adjustments and deductions from regulatory capital. These deductions typically address the high degree of uncertainty that these items have a positive realisable value in periods of stress and are mostly applied to CET1. Important deductions are goodwill and other intangible assets, deferred tax assets and investments in other financial entities. Tier 1 capital is used to describe the capital adequacy of a bank and refers to its core capital, including equity capital and disclosed reserves. Tier 1 capital consists of shareholders' equity and retained earnings—disclosed on their financial statements—and is a primary indicator to measure a bank's financial health.

- National supervisors may provide guidance on the reference rates that are permitted in their jurisdictions or may disallow inclusion of an instrument in regulatory capital if they deem the reference rate to be credit sensitive.

- The criteria for Tier 2 inclusion are less strict than for AT1, allowing instruments with a maturity date to be eligible for Tier 2, while only perpetual instruments are eligible for AT1.

- The holder of the instrument must have no contractual right to accelerate payment of principal or interest on the instrument, except in the event of a receivership, insolvency, liquidation, or similar proceeding of the national bank or Federal savings association.

New thresholds are applied to certain of the deductions under Basel III. Banks receive limited recognition for their significant investments in the common shares of unconsolidated financial institutions, mortgage servicing rights and deferred tax assets that arise from temporary differences. Each item is individually capped at 10% of the bank's common equity after the application of certain regulatory adjustments, and the aggregate is limited to 15% of the bank's CET1. Non-significant investments in unconsolidated financial institutions (that is, where the bank owns less than 10% of the common shares) are only deducted to the extent that all such exposures in aggregate exceed 10% of the bank's common equity. Tier 2 capital includes undisclosed funds that do not appear on a bank's financial statements, revaluation reserves, hybrid capital instruments, subordinated term debt—also known as junior debt securities—and general loan-loss, or uncollected, reserves. Revalued reserves is an accounting method that recalculates the current value of a holding that is higher than what it was originally recorded as such as with real estate.

This creates a risk that the automatic rollover could be subject to legal challenge and repayment at the maturity date could be enforced. As such, instruments with maturity dates and automatic rollover features should not be treated as perpetual. The instrument cannot have a credit-sensitive dividend feature, that is a dividend/coupon that is reset periodically based in whole or in part on the banking organisation's credit standing. Cancellation of distributions/payments must not impose restrictions on the bank except in relation to distributions to common stockholders.

The portion of the consolidated minimum Common Equity Tier 1 requirement plus the capital conservation buffer (ie 7.0% of consolidated RWA) that relates to the subsidiary. For the purposes of this paragraph, any institution that is subject to the same minimum prudential standards and level of supervision as a bank may be considered to be a bank. Recognition in regulatory capital in the remaining five years before maturity will be amortised on a straight line basis. The objective of Tier 2 is to provide loss absorption on a gone-concern basis. Based on this objective, the following criteria must be met or exceeded for an instrument to be included in Tier 2 capital. The intention of the criterion is to prohibit the inclusion of instruments in capital in cases where the bank retains any of the risk of the instruments.

Capital Adequacy- Measurement of strength and soundness

The System institution must receive the prior approval of FCA to exercise a call option on the instrument. The System institution must receive prior approval from FCA to exercise a call option on the instrument. The holder of the instrument must have no contractual right to accelerate payment of principal or interest on the instrument, except in the event of a receivership, insolvency, liquidation, or similar proceeding of the national bank or Federal savings association. The national bank or Federal savings association does not create at issuance, through action or communication, an expectation the call option will be exercised.

Regulators require banks to hold certain levels of Tier 1 and Tier 2 capital as reserves, in order to ensure that they can absorb large losses without threatening the stability of the institution. Under the Basel III accord, the minimum Tier 1 capital ratio was set at 6% of a bank's risk-weighted assets. A Board-regulated institution may not repurchase or redeem any common equity tier 1 capital, additional tier 1, or tier 2 capital instrument without the prior approval of the Board to the extent such prior approval is required by paragraph , , or of this section, as applicable. Capital in this sense is related to, but different from, the accounting concept of shareholders' equity.

Minimum standards and use of internal models

Both Tier 1 and Tier 2 capital were first defined in the Basel I capital accord and remained substantially the same in the replacement Basel II accord. Tier 2 capital represents "supplementary capital" such as undisclosed reserves, revaluation reserves, general loan-loss reserves, hybrid (debt/equity) capital instruments, and subordinated debt. CRAR is a ratio that determines the bank’s capacity to meet the time liabilities and other risks carried by the assets of the banks. In simple words CRAR explains the capital requirement for potential losses and protects the bank’s depositors and other lenders.

Basel III norms resulted in the tightening of Tier 1 capital norms and the introduction of the Tier 1 leverage ratio to prevent excessive build-up of leverage and to increase the capacity of the banks’ capital to cushion possible losses from its exposures. A more robust Tier 1 capital ratio indicates a better ability of the bank to be able to absorb losses. Therefore, as a general rule of thumb, the higher the ratio, particularly the CET1 capital ratio, the better. The Basel III accord introduced a regulation that requires commercial banks to maintain a minimum capital ratio of 8%, 6% of which must be Common Equity Tier 1. The Basel III accord was introduced in 2009 as a response to the 2008 Global Financial Crisis and as part of continuous efforts to improve the banking regulatory framework. For calculating regulatory capital for banks with investments in other financial institutions there should be no double-counting of capital.

The Difference Between the Tier 1 Capital Ratio and the Tier 1 Leverage Ratio

Under the Basel III accord, the value of a bank's Tier 1 capital must be greater than 6% of its risk-weighted assets. Any distributions on the instrument are paid out of the Board-regulated institution's net income, retained earnings, or surplus related to other additional tier 1 capital instruments. State member banks are subject to other legal restrictions on reductions in capital resulting from cash dividends, including out of the capital surplus account, under 12 U.S.C. 324 and 12 CFR 208.5. Amendments to the contractual terms of capital instruments could potentially trigger a reassessment of their eligibility as regulatory capital in some jurisdictions. A reassessment could result in an existing capital instrument being treated as a new instrument. This in turn could result in breaching the minimum maturity and call date requirements.

Tier 3 capital is tertiary capital, which many banks hold to support their market risk, commodities risk, and foreign currency risk, derived from trading activities. Tier 3 capital includes a greater variety of debt than tier 1 and tier 2 capital but is of a much lower quality than either of the two. A bank's total capital is calculated by adding its tier 1 and tier 2 capital together. Regulators use the capital ratio to determine and rank a bank's capital adequacy. The tier 1 leverage ratio relates a bank's core capital to its total assets in order to judge liquidity.

Largely in response to the credit crisis, banks are required to maintain proper leverage ratios and meet certain minimumcapital requirements. The tier 1 leverage ratio is the relationship between a banking organization's core capital and its total assets. The tier 1 leverage ratio is calculated by dividing tier 1 capital by a bank's average total consolidated assets and certain off-balance sheet exposures. Similarly to the tier 1 capital ratio, the tier 1 leverage ratio is used as a tool by central monetary authorities to ensure the capital adequacy of banks and to place constraints on the degree to which a financial company can leverage its capital base but does not use risk-weighted assets in the denominator.